For those seeking a successful lifestyle, individuals often find themselves navigating through various avenues and opportunities. However, a silent adversary can block your progression to a better life. For instance, the concept of indicators that represent living beyond one’s means, which I call “Dream Stealers,” have crept into one’s lifestyle, hindering financial growth and preventing individuals from seizing opportunities for advancement.

Picture this scenario: a millionaire entrepreneur is searching for a business partner. As they drive through a prospective candidate’s neighborhood, they note the lavish homes and expensive cars lining the streets. While these outward displays of wealth may seem impressive at first glance, to the discerning eye of the millionaire, they raise red flags.

Living beyond one’s means often entails maintaining an unsustainable lifestyle based on income or financial resources. Indicators of Dream Stealers could include:

-

- Purchasing a home or vehicle that stretches the limits of affordability.

- Frequent extravagant spending.

- Accumulating debt to finance a lavish lifestyle.

While it may provide temporary gratification, it sets a dangerous precedent that can have long-term repercussions.

From the millionaire’s perspective, these outward displays of wealth may signal a potential partner is overly reliant on external resources rather than building their financial foundation. The millionaire may view such individuals as liabilities rather than assets, as their lifestyle choices could hinder their ability to contribute meaningfully to a business relationship.

One such entrepreneur pointed to a prospective partner’s car and said, “That could have opened a profitable coffee stand or been the down payment on a business investment that could be providing passive income to support his family better.” Whether true or not, not having an adequate investment portfolio to support his car and home caused the entrepreneur to conceive that this individual was a poor risk or may have some exposure to criminal elements.

Consider the implications for the millionaire entrepreneur: if they were to enter into a partnership or a relationship with someone living beyond their means, it could jeopardize their financial stability and inhibit their ability to grow their wealth. Instead of focusing on seizing opportunities for investment and advancement, they would be burdened with supporting a partner who needs help to sustain their lifestyle.

Furthermore, the millionaire may recognize that individuals who live beyond their means are less likely to prioritize financial responsibility and long-term planning, posing a risk to the success of the partnership or relationship and the overall economic health of both parties involved.

Dream Stealers undermine the potential for mutual growth and prosperity by fostering a mindset of dependence rather than independence. They create a barrier to financial success by diverting resources towards sustaining an extravagant lifestyle rather than investing in opportunities for advancement.

It’s highly beneficial to surround oneself with individuals with similar values and priorities regarding financial responsibility. By forming partnerships and relationships with people who prioritize financial independence and growth, individuals can create a support system that encourages wise decision-making and mutual advancement.

You don’t have to be a millionaire to realize the importance of remaining vigilant and discerning when evaluating potential partners or opportunities. While outward displays of wealth may be impressive, true compatibility and potential for growth lie in shared values, goals, and a commitment to financial responsibility.

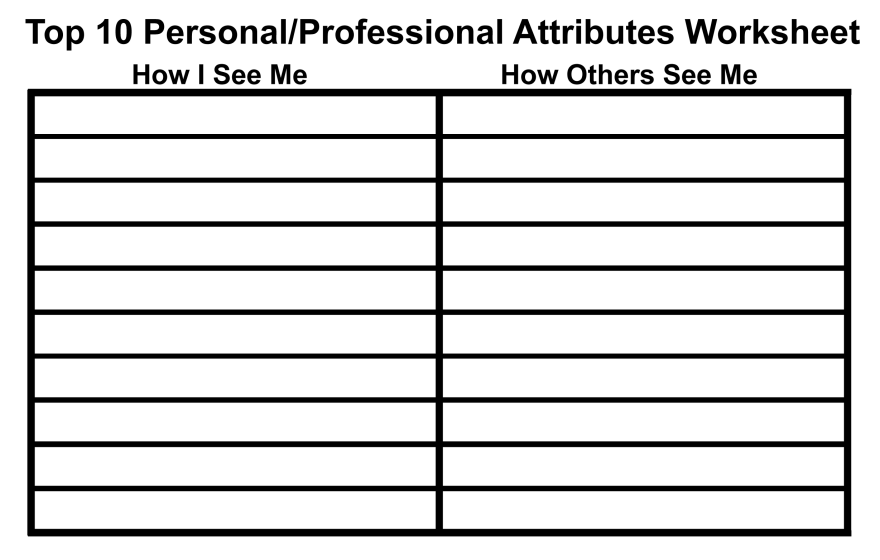

Top 10 Signs of Dream Stealers

-

- Living in a home or driving vehicles that appear significantly beyond their means.

- Frequent displays of extravagant spending on luxury items or experiences.

- High debt levels relative to income, especially if used to finance a lavish lifestyle.

- A lack of financial discipline, such as impulse buying or inability to budget responsibly.

- Prioritizing appearances and outward displays of wealth over long-term fiscal stability.

- Reluctance or inability to discuss financial matters openly and transparently.

- Dependence on others for financial support or assistance in maintaining their lifestyle.

- Limited savings or investments for future financial security.

- Resistance to constructive feedback or advice regarding financial responsibility.

- A pattern of seeking instant gratification rather than investing in long-term goals or opportunities.

In contrast, here are behaviors that may indicate an individual could be a better business risk:

Top 10 Indicators of a Good Business Risk

-

- They demonstrate financial prudence by living within their means and maintaining a balanced lifestyle.

- They make informed and strategic financial decisions based on long-term goals and priorities.

- They invest in personal and professional development to enhance their skills and knowledge.

- They have a track record of responsible financial management, including saving and investing for the future.

- Being open and transparent about their financial situation and receptive to feedback or advice.

- They exhibit a strong work ethic and commitment to achieving success through hard work and dedication.

- They are building a network of trusted advisors and mentors who provide guidance and support in achieving their goals.

- Display resilience and adaptability in the face of challenges or setbacks, demonstrating the ability to navigate financial obstacles effectively.

- Maintain a healthy balance between work and personal life, prioritizing relationships and well-being alongside professional pursuits.

- Continuously seek opportunities for growth and advancement, personally and professionally, while remaining grounded and focused on long-term success.

It’s important to note that these are general indicators and should be considered within individual circumstances and specific business or personal relationships. A comprehensive assessment of someone’s financial habits, values, and goals is necessary to determine whether they are a good fit for a business partnership or investment opportunity.

Is There Hope for One Who Suffers from the Dream Stealers Lifestyle?

Changing a lifestyle surrounded by Dream Stealers can be challenging. Still, with dedication and determination, individuals can transform themselves into a better risk and embody a powerfully self-propelled and upwardly mobile personality. Here are some strategies to consider:

Assess Current Habits and Mindset:

Start by reflecting on current habits, attitudes, and beliefs about money and success. Identify any patterns of overspending, reliance on external validation, or fear of failure that may block your success.

Set Clear Financial Goals:

Define specific, measurable, and achievable financial goals that align with your values and aspirations. Whether it’s paying off debt, building an emergency fund, or investing for the future, having clear objectives will provide direction and motivation for change.

Create a Budget and Stick to It:

Develop a respectable budget that outlines your income, expenses, and savings goals. Take the effort to monitor your spending and adjust your budget as needed to ensure you’re living within your means and prioritizing essential expenses over discretionary ones.

Cultivate Financial Discipline:

Practice discipline in your spending habits by distinguishing between wants and needs. Prioritize essential expenses and avoid impulsive purchases or unnecessary luxuries that detract from your long-term financial goals.

Educate Yourself About Personal Finance:

Make a concerted effort to educate yourself about personal finance including such topics as budgeting, saving, investing, and debt management. Use resources such as books, online courses, or financial advisors to enhance your knowledge and skills.

Surround Yourself with Successful Personalities: You can attract genuine success by osmosis. Seek out individuals who embody the traits and values you aspire to cultivate. Surround yourself with positive influences supporting your financial growth journey and encourage responsible decision-making.

Practice Self-Reflection and Accountability:

Regularly evaluate your progress towards your financial goals and hold yourself accountable for your actions. Be honest about areas where you may fall short and identify improvement strategies.

Adopt an Upwardly Growth-Oriented Mindset:

Adopt an upwardly growth-oriented mindset that views obstacles and setbacks as opportunities with hidden messages leading to a higher understanding and growth. Embrace failure as a natural part of the journey towards success and remain resilient in the face of obstacles.

Take Calculated Risks:

Investigate vistas outside of your comfort zone and be willing to take calculated risks. This builds courage and exposes you to increased potential for moving you to an increased financial set point. Whether starting a new business venture, pursuing a career change, or investing in growth opportunities, be strategic in your decision-making and assess the potential rewards against the risks involved.

Celebrate Milestones and Create a New Financial Set Point:

Recognize and celebrate your achievements and reset your financial set point along the way. Acknowledge your progress towards your financial goals and use it as motivation to attain a new level of financial frequency.

By implementing these strategies and consciously changing your habits and mindset, you can transform yourself into a better risk and embody a powerfully self-propelled and upwardly mobile personality. Remember that change takes time and persistence, but with diligence, dedication, and determination, you can create a brighter financial future for yourself.

The concept of Dream Stealers serves as a cautionary tale against the dangers of living beyond one’s means. By prioritizing financial responsibility, cultivating relationships with like-minded individuals, and remaining discerning in their pursuits, individuals can overcome the influence of Dream Stealers and carve out a new path to long-term financial success and prosperity.